- 12 Y 13 DE OCTUBRE DE 2023 -

Universidad Anáhuac

Querétaro, México

El Congreso FIMEF es auspiciado por la Fundación de Investigación del Instituto Mexicano de Ejecutivos de Finanzas (IMEF) y la Universidad Anáhuac, con colaboración de trece instituciones mexicanas de educación superior.

PONENTES

FCEE: Universidad Panamericana Campus Guadalajara

PROGRAMA

jueves 12 de octubre

| 09:30 am - 10:00 am | Ceremonia Inaugural |

| 10:00 am - 11:00 am | VII FIMEF Finance Diamond Award Dr. Francisco Venegas Martínez |

| 11:00 am - 12:00 pm | Conferencia Magistral El rol del banco central en las finanzas sostenibles Dr. Ernesto Sepúlveda Villarreal |

| 11:00 am - 12:00 pm | Rueda de Prensa |

| 12:00 pm - 01:00 pm | FIMEF | Reconocimiento a expresidentes |

| 12:20 pm - 02:20 pm | Sesiones Simultáneas I |

| 12:20 pm - 01:20 pm | Congreso 2024 | Universidad Panamericana Determinantes operativos y financieros de los operadores de agua en México Dr. Hugo Briseño Ramírez |

| 12:30 pm - 01:30 pm | Sesión Especial Empoderar a las mujeres con inclusión financiera Lic. Mara Echave González |

| 02:20 pm - 03:40 pm | Comida |

| 04:00 pm - 06:00 pm | Sesiones Simultáneas II |

| 01:20 pm - 02:20 pm | Sesión Especial Impacto de las prácticas ASG en la valoración de empresas: el caso del sector construcción Lic. Vanessa Quiroga |

| 01:20 pm - 02:20 pm |

Sesión Especial Instrumentos Financieros Convencionales y no convencionales en la BMV Mtro. Gerardo Aparicio Yacotú |

| 04:00 pm - 05:00 pm |

Sesión Especial Economía circular en el Estado de Querétaro Ing. Marco del Prete |

| 06:00 pm - 07:00 pm |

Conferencia Magistral Modelo de tres factores para la curva de tasas con volatilidad estocástica Dr. Raúl Álvarez del Castillo Penna |

| 07:00 pm - 08:30 pm | Cocktail – Networking |

viernes 13 de octubre

| 10:00 am - 11:00 am | Conferencia Magistral "Proyecto El Gran Bajío" Mtro. Federico Quinzaños |

| 11:00 am – 01:00 pm | Sesiones Simultáneas III |

| 11:00am - 12:30 pm | Panel de Editores Dr. Francisco Venegas Martínez - Revista Mexicana de Economía y Finanzas (IMEF) Dr. Gerardo Hernández del Valle - Latin American Journal of Central Banking (CEMLA) Dra. Alenka Guzmán - Economía Teoría y Práctica (UAM) |

| 11:30am - 12:30 pm | Sesión Especial Regulación en materia de ESG/Sostenibilidad que impacta los negocios en México y América Latina C.P. Juan Manuel Puebla y Lic. Ruth Guevara Ernst & Young |

| 11:00 am – 12:00 pm | Sesión Especial Impacto de las cajas populares en el crecimiento y desarrollo Cooperativas de ahorro, Crédito y Cajas populares Mtro. Carlos Almaraz Mendoza |

| 12:00 pm – 01:00 pm | Presentación de Carteles |

| 12:00 pm – 01:00 pm | Sesión Especial La importancia del blockchain en los mercados financieros actuales Act. Alejandro Mérida Hernández |

| 01:00 pm – 02:00 pm | Conferencia Magistral Finanzas, Machine Learning e Inteligencia Artificial Dr. Gerardo Hernández del Valle |

| 02:20 pm – 03:40 pm | Comida |

| 04:00 pm – 06:00 pm | Sesiones Simultáneas IV |

| 04:00 pm – 05:00 pm | Sesión Especial COMITÉ RESPONSABILIDAD SOCIAL IMEF Equilibrio de la innovación financiera con la responsabilidad social Lic. Ana Paula Badilla Robledo |

| 05:00 pm – 06:00 pm | Sesión Especial Presentación libro |

| 04:30 pm – 05:30 pm | Sesión Especial Grupo IMEF Querétaro Fintech, motor de la inclusión financiera en México Mtro. Carlos Camacho, Mtra. Araceli Jiménez, Mtro. Jorge Meyran, Dr. Andrés Mejía Amaya |

| 06:00 pm – 07:00 pm | Conferencia Magistral QUANTUM FINANCE Dr. Francisco Venegas Martínez |

| 07:00 pm – 07:30 pm | Ceremonia de Clausura |

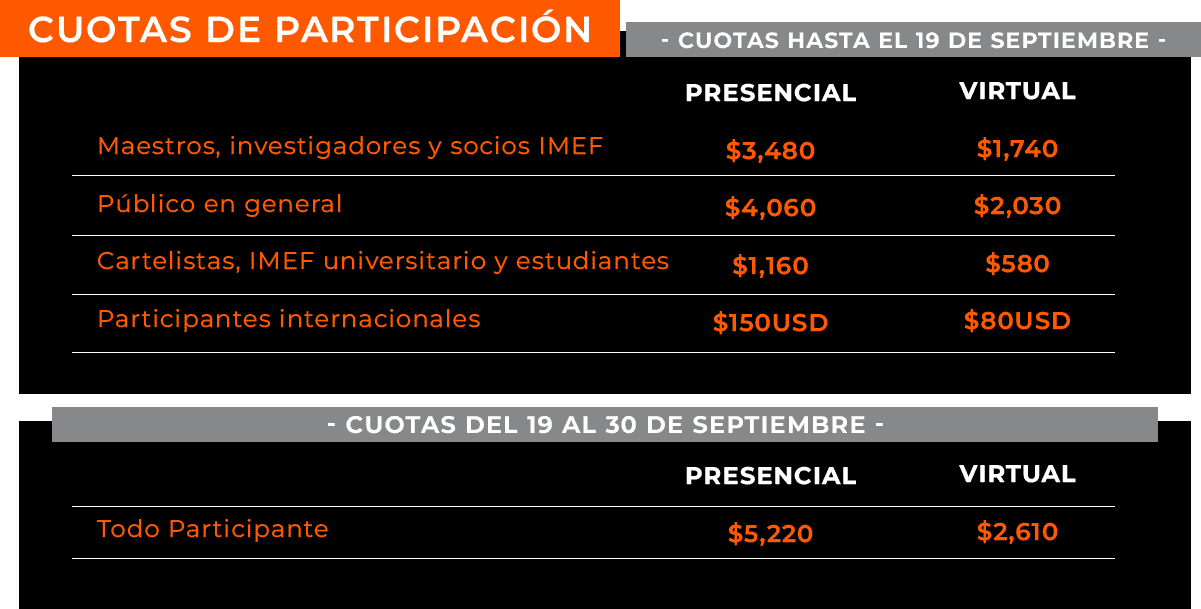

TODAS LAS CUOTAS SON EN MONEDA NACIONAL E INCLUYEN I.V.A.

¿QUÉ INCLUYE TU REGISTRO?

● Participación en las actividades del programa

● Constancia electrónica de participación

● Programa general del Congreso

● Acceso a la transmisión de todas las conferencias y páneles en vivo desde tu computadora o dispositivo móvil. (Entrada Virtual)

● Acceso a la plataforma interactiva del evento para hacer networking con los asistentes, interactuar con los expositores y descargar contenido.

● Networking y experiencia completa en nuestra universidad sede (Boleto presencial)

ACTIVIDADES RECREATIVAS

La Universidad Anáhuac a través de la escuela de turismo pone a su disposición el contacto del proveedor de servicios turísticos.

Para consultar las actividades dentro de cada paseo solicita mayor información con Play Trip: carlos@playtrip.mx / WhatsApp: 4423538983

¿Tienes dudas? Contáctanos

EVENTO PATROCINADO POR: